The ITAR Imperative

The International Trade in Arms Regulations (ITAR) regulates and controls the export of defense and military-related technologies to safeguard U.S. national security and further U.S. foreign policy objectives[1]. Most of us working within the U.S. defense trade always keep a copy of the ITAR next to us because it provides guidance to conduct business properly. However, much of the time, we are primarily concerned with the utility of the former portion of the definition of the ITAR “regulate and control the export of defense and military-related technologies,” and give little thought to the latter portion of the definition of the ITAR that implies why the first portion is so important “…to safeguard U.S. National Security and further U.S. foreign policy objectives”. It is imperative, especially in today’s globalized defense industrial landscape, that we consistently remind ourselves about the purpose of the ITAR and why adherence to its regulations and control is more critical now than ever before.

Since the end of the cold war, the U.S. defense supply chain has become more diffused and internationalized, causing U.S. defense companies to share ever increasing amounts of technology and technical data around the globe to strengthen supply chains. Moreover, with this diffusion and internationalization of the U.S. defense industrial base, the ITAR, and subsequently U.S. influence, has stretched its reach and control over almost every arms-producing nation in the world, directly assisting the U.S. to achieve its foreign policy objectives. This thought piece will outline how the worlds defense industrial landscape has changed since the cold war and how these changes have made ITAR compliance more critical than ever.

Post-Cold war contraction and merger mania

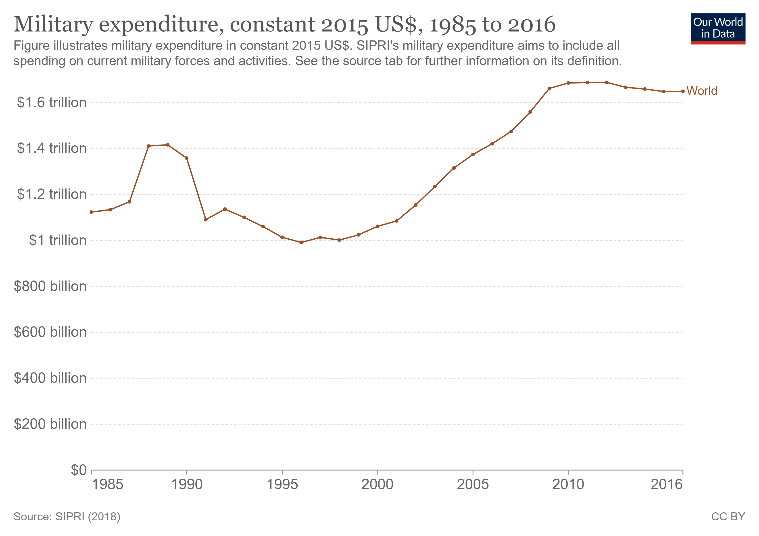

Today’s defense industrial landscape is essentially a product of the massive contraction in military expenditure that followed the end of the cold war. As the world disarmed and demilitarized, the demand for new weapon systems and the budgets for those systems declined dramatically. In the years following the end of the cold war, global military expenditure fell by almost one-third. Total global military spending continued to decline from 1991 until 1998, when it rose to its peak in 2011, driven primarily by U.S. military involvement in the middle east and southwest Asia. During this time of meager defense spending, developed countries sought to retain and maintain their domestic defense industrial bases through various subsidies, mergers, and export regulation reform. Undoubtedly, however, the end of the cold war left the global arms trade system bloated from years of profit and saddled many nations with industries providing more capacity and capability than most nations needed or could even afford.

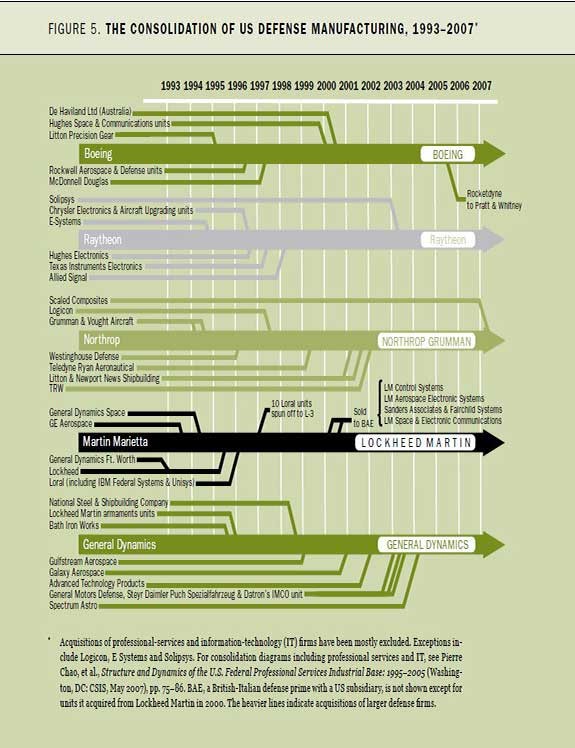

Large arms supplying nations such as the U.S. were left with thousands of defense workers made redundant, thus forcing military industries to cut back on production or even close. After the cold war defense industry boom, the U.S. witnessed a period of merger mania as the government-subsidized mergers of companies like Lockheed, Martin Marietta, Northrop and Grumman, Boeing and McDonald Douglas to mitigate the economic damage from reductions in military spending[2]. In 1991 military mergers in the U.S. were valued at around 300 million, and by 1993, it had climbed to 14.2 billion. [3] So dramatic was the contraction of the U.S. defense industrial base that in the 1980s, 20 or more prime industries competed for most U.S. defense contracts; however, by 2007, the Pentagon relied heavily on just 6.[4]

Pursuit of exports

Although the contracting defense landscape greatly affected the large defense industries in first-tier states, their survival was never in doubt, because their products were still the most sought after on the international arms market. The U.S. government, anticipating lower domestic defense spending after the cold war, spurred the U.S. defense industry to begin to seek foreign markets to offset decrease spending. U.S. weapons systems have traditionally been built primarily for the U.S. armed forces, with only secondary consideration being given to foreign sales. Today U.S. defense firms and their DOD program counterparts actively consider incorporating exportability into systems and subsystems likely to be exported to U.S.[5] In 2010 only 17 percent of defense equipment manufactured in the U.S. was exported, and by 2015 it had risen dramatically to 34 percent[6] . The first strategy of the U.S. Defense was to internationalize their arms procurement activities, relying on the smaller second-tier states to produce components of U.S. defense goods. This reliance allowed U.S. defense firms to enter foreign markets and significantly reduced unit prices compared to producing the entire defense good in the U.S. Second-tier states have now become loyal buyers of U.S. equipment to keep their own domestic defense industrial base operation, and the U.S. military has been able to benefit from decreased procurement costs and decreases in subsidization of research and development of U.S. defense goods. Second-tier states essentially leverage their comparative advantages: niche strengths, manpower, money, and markets. Today, every large U.S. defense firm has a presence in a foreign country, whether through joint production, joint ventures, or foreign equity ownerships.

Supply chain internationalization

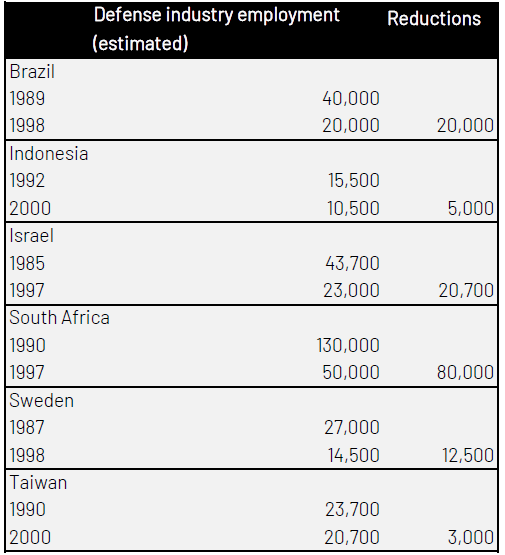

If the defense industry in the U.S., the largest defense exporter on the planet, was significantly affected by the shortage of military expenditure following the cold war, we can safely assume that smaller countries were affected to an even greater extent. Figure 3 illustrates the massive reduction of defense industry employment from selected second-tier suppliers[7]. Prior to the end of the cold war, second tier[8] suppliers actively pursued defense autarky, or self-sufficiency. Countries like Austria and Argentina poured massive amounts of capital into their defense industrial base to pursue defense autarky. Weapon systems during this period were expensive to develop but nowhere near the costs associated with the development of modern high-tech weapons systems today. Without domestic military spending, a robust industrial base and knowledge pool to draw from, many of these countries have had to scale back their ambitions and accept a lesser role in the global arms production system.

Despite the often-professed goal of self-sufficiency, many smaller second-tier arms producers have largely failed to eliminate or even substantially reduce their dependencies on foreign technologies due to continued deficiencies and weaknesses in their domestic research and development and manufacturing bases. Recent industrial re-adjustment strategies undertaken by many of these second-tier arms-producing countries point to their increasingly subordinate role in a more globalized and interdependent worldwide defense industry.

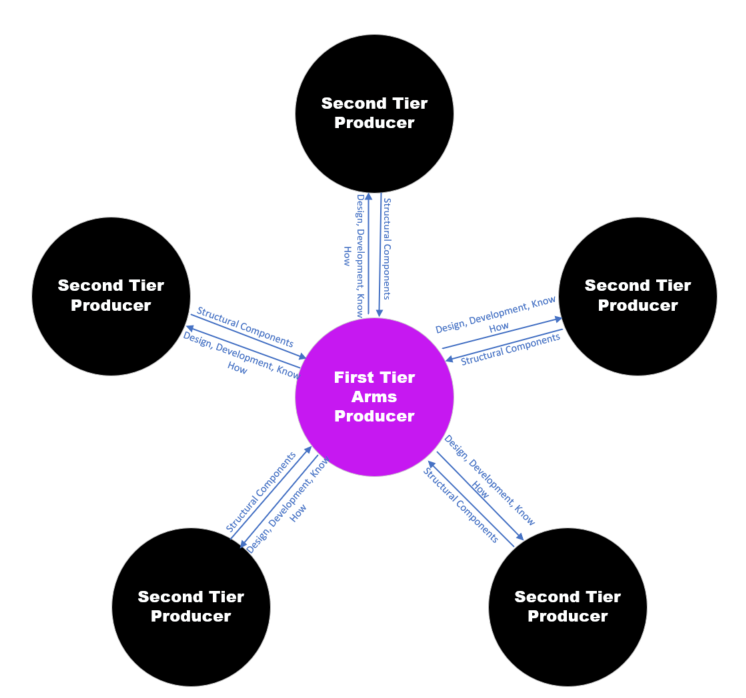

Structurally, this new system resembles a hub and spoke model, as illustrated in Figure 4. This model is comprised of a few large first tier arms firms operating at the center, who provide the process of armaments production with its critical design, development, and manufacturing know-how to second-tier states on the periphery who then provide first tier arms suppliers with structural components to be assembled into the final defense article. Although such a global division of labor in arms production will probably bring new economic and technological benefits to many second-tier arms producers[9], it will likely entail the abandonment of their original self-sufficiency objectives.

Offsets: Adding fuel to internationalization

Many importing states have pursued defense offsets to help ease the financial burden of large defense purchases from the U.S. Others, like Saudi Arabia, has pursued direct offsets in the hope that the U.S. can jumpstart their own defense industries to pursue defense self-sufficiency. It is estimated that between 2010 and 2020 the U.S. will incur $367 billion in defense offsets[10]. Although the U.S. views offsets as ‘economically inefficient and trade distorting’ [11],[12],[13],[14] , and are prohibited under the World Trade Organization (WTO) Agreement on Government Procurement (GPA)[15], they are undoubtedly here to stay, especially as the unit costs of prime defense goods keep increasing[16],[17],[18] , .

This isn’t to say that offsets aren’t also beneficial to first-tier suppliers such as the U.S. In many instances’ offsets help first-tier arms suppliers tap into markets that would be difficult to access otherwise. For example, in 1985, Boeing established the Boeing Industrial Technology Group to help meet offset obligations related to the sale to Saudi Arabia of its Peace Shield air defense system. This group has fostered a deep relationship with the Saudi Arabian government through partnering in various economic development efforts, which has allowed Boeing to leverage its goodwill to help sell its F-15 fighter aircraft and AH-64 Apache Attack Helicopter.

Unfortunately, most countries attempting to use offsets to develop an independent manufacturing base are trading one pair of chains (direct dependence on foreign equipment), for another (tied directly to U.S. regulatory restrictions). First-tier arms producers, namely the U.S., may be willing to part with technical data and manufacturing processes for low-tech end-system components, but the ‘crown jewels of U.S. weapons systems remain off-limits due to ITAR regulatory restrictions. The abstention of high-tech defense technology limits the ability of second-tier states to acquire enough knowledge to produce indigenously designed defense goods that are competitive in the world defense market, thus ensuring the primacy of first-tier arms suppliers.

ITAR Compliance is a necessity

The defense industrial landscape has changed dramatically since the end of the cold war. The increased internationalization of the defense industrial landscape and the greater emphasis being placed on offsets by most countries place greater importance on strengthening government security and export regulations. We can all agree that the ITAR can benefit from streamlining and updating. Still, the importance of ITAR regulatory compliance has never been greater, nor have the costs of non-compliance, both for exporting companies and national security, ever been higher.

[1] See U.S. State Department – Policy – Directorate of Defense Trade Controls (archive.org).

[2]Hartung, William D. “The Military-Industrial Complex Revisited: Shifting Patterns of Military Contracting in the Post-9/11 Period.” Costs of War. 2011.

[3]Korb, Lawrence. “Merger Mania: Should the Pentagon Pay For Defense Industry Restructuring?” Brookings, 28 July 2016, www.brookings.edu/articles/merger-mania-should-the-pentagon-pay-for-defense-industry-restructuring. [1]Mason, Shane. “The Evolving Geography of the U.S. Defense Industrial Base.” War on the Rocks, 1 Sept. 2021, warontherocks.com/2021/09/the-evolving-geography-of-the-u-s-defense-industrial-base.

[4]IC – Defense Exportability Features (osd.mil) The DoD exportability Features (DEF) initiatives have sought to demonstrate that costs can be reduced and U.S. products can be made to foreign sales sooner through thoughtful incorporation of exportable design features.

[5]Sandra I. Erwin. “Changing Landscape Overseas Creates Headwinds for U.S. Defense Companies.” National Defense Magazine, 23 May 2016, www.nationaldefensemagazine.org/articles/2016/5/23/changing-landscape-overseas-creates-headwinds-for-us-defense-companies.

[6] Figures come from Bitzinger, R., 2003. Towards a brave new arms industry?. Oxford: Oxford University Press for the International Institute for Strategic Studies, p.67.

[7]Arms trade literature commonly places arms producers into hierarchical model delineated by first, second and third tier arms producing states; however, there is no consensus as to the formal definition of each tier. For the purposes of this paper, I prefer to use the definition used in Krause (1992:31). “First tier arms suppliers innovate at the technological frontier. Second Tier suppliers produce (via the transfer of capacities) weapons at the technological frontier and adapt them to specific markets. Third tier suppliers copy and reproduce existing technologies (via transfer of design), but do not capture the underlying process of innovation or adaptation.”

[8] Benefits will likely come in the form of spin-offs from defense industry investment.

[9]Barney, Jon, et al. “America first? Us defense exports in the trump era.” Avacent, Jan. 2017, www.avascent.com/wp-content/uploads/2017/01/white_paper_america_first_01292017.pdf.

[10]Department of Commerce (USA), offsets in defense trade: thirteenth report to congress, December 2008, offsets in defense trade (doc.gov)

[11] Although the U.S. looks upon the practice of offsets as ‘economically inefficient and trade distorting’, many us defense procurements contain ‘buy American’ clauses, which amount to an unofficial ‘compensation’ program by requiring defense platforms to be built substantially in-country.

[12] Davies n. (2009) the economics of offsets, presentation delivered at NATO conference ‘building integrity and defense institution building’, draft report, Monterey conference center, 25-27 February 2009, available at www.defenceagainstcorruption.org/publications

[13] Magahy, ben, et al. “defense offsets addressing the risks of corruption & raising transparency.” Transparency international, Apr. 2010, ti-defence.org/wp-content/uploads/2016/03/1004_corruption_risk_offsets.pdf.

[14] the GPA defines offsets as “measures used to encourage local development or improve the balance of payments accounts by means of domestic content, licensing of technology, investment requirements, counter-trade or similar requirements.”. However, there are exceptions: for developing countries acceding to the GPA, offsets can be negotiated in the qualification phases of tenders as long as they are not considered as award criteria and procurement processes can be excluded from the scope of the GPA, and thus the prohibition of offsets, if governments find it necessary to protect their national security interests . By being excluded from the agreement, these processes can encompass offsets. The latter exception is used by most countries to demand defense offsets.

[15] The US Navy’s procurement costs is a prime example of defense cost growth. In the 1980’s the US Navy purchased 17 ships per year at an average cost of 1.2 billion (2009 dollars) per ship. By the 2000’s, the average cost had increased to 2.0 billion per ship for about 6 ships per year.

[16] See:Eaglen, Mackenzie. “U.S. Defense Spending: The Mismatch Between Plans and Resources.” The Heritage Foundation, 7 June 2010, www.heritage.org/defense/report/us-defense-spending-the-mismatch-between-plans-and-resources.

[17] Labs, Eric. “The Long-Term Outlook for the U.S. Navy’s Fleet.” Congressional Budget Office, 20 Jan. 2010, www.cbo.gov/sites/default/files/111th-congress-2009-2010/reports/01-20-navyshipbuilding.pdf.

[18] Eaglen, Mackenzie. “U.S. Defense Spending: The Mismatch Between Plans and Resources.” The Heritage Foundation, 7 June 2010, www.heritage.org/defense/report/us-defense-spending-the-mismatch-between-plans-and-resources.

Comments